Coca Cola SWOT Analysis

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Coca Cola SWOT analysis:

| Strengths 1. Ownership of leading brands in soft drinks market segment

2. Brand value 3. Highly sophisticated distribution channel 4. Solid financial position |

Weaknesses 1. Lack of clear competitive advantage over PepsiCo

2. Brand image is associated with ‘high sugar’ carbonates 3. Lack of product diversification 4. Negative publicity |

| Opportunities 1. Focusing on health & wellness

2. Engaging in product diversification and brand extension 3. Packaging innovation 4. Engagement in acquisitions |

Threats 1. Consumer avoidance from soft drinks due to health considerations

2. Loss of market share to PepsiCo 3. Negative publicity due to water usage patterns 4. Changes in currency exchange rates |

Strengths

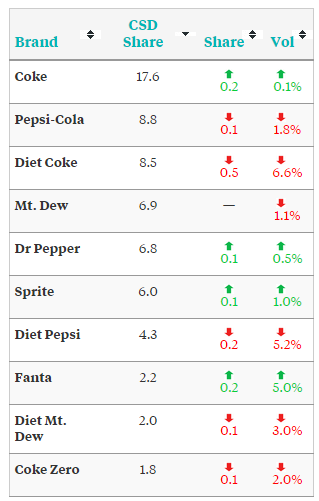

1. The company owns and markets four of the five leading brands in the market – Coca-Cola, Diet Coke, Fanta and Sprite. As it is illustrated in Figure 1 below, in 2014, products belonging to Coca Cola Company possessed 36.1% market share in carbonated soft drinks segment in the USA. Significant market share is associated with a solid revenue stream that can be channeled to new product development and marketing initiatives to contribute to long-term growth prospects.

2. Estimated at $81.6 billion, Coca Cola brand value is the 3rd valuable brand in the world. This position provides the company a set of substantial benefits in terms of customer loyalty and bargaining power with suppliers. Moreover, a great brand value is a confirmation of efficiency of competitive advantage and it also provides grounds to increase profit margin.

3. Coca Cola Company has a highly sophisticated distribution channel that enables the sales of more than 2 billion unit cases of products across 28 countries and three continents. Coca Cola products are distributed via large distributors and many manual distribution centers around the world. Coca Cola manual distribution program allows independent entrepreneurs to set up distribution centers in behalf of the company. More than 2500 independent manual distribution businesses across Africa have created jobs for more than 11,000 people at the same time contributing more than $500 million in annual revenue[1]. Moreover, thanks to its advanced distribution system in place, the company generates additional revenues via distributing third-party brands, including DPSG brands, Nestea products and others.

4. During the year of 2014 alone, Coca Cola has generated net operating revenues of $45.9 billion and the net income of $7.1 billion. Moreover, with the market capitalization of $184.3 billion and 20 billion-dollar brands in its portfolio, The Coca Cola Company is in a solid financial position which provides opportunities to further increase competitive advantage via new product development, marketing and in many other ways.

Weaknesses

1. PepsiCo is the main competitor for Coca Cola and Coca Cola possesses no clear and sustainable competitive advantage over PepsiCo. As illustrated in Table 2 below, PepsiCo’s market capitalization of $147 billion is close to Coca Cola’s $184.3 billion and there are no major differences between the key performance indicators of two companies. Also, PepsiCo’s also portfolio also possesses a range of global valuable brands such as Gatorade, Tropicana, Lipton and Starbucks RTD beverages. The absence of clear competitive advantage is associated with a constant risk of losing market share to PepsiCo.

| Performance indicators | Coca Cola | PepsiCo |

| Market capitalization | $184.3 billion | $147 billion |

| Number of billion-dollar brands in portfolio | 20 | 22 |

| Average annual growth rate | 9% | 9% |

| Dividend yield | 2.9% | 2.7% |

| Constant-currency adjusted earnings-per-share | 7.9% | 9% |

| Share price advance for last 12 months | 13% | 25% |

Coca Cola vs. PepsiCo main indicators[2]

2. Coca Cola brand image is closely associated with high sugar carbonates and this does not resonate well with growing obesity and health concerns among increasing number of population around the globe. Also the company has also developed low and zero calorie drinks, it may take considerable amount of time and effort to disassociate Coca Cola Company from high sugar carbonated drinks…

Coca Cola Company Report contains SWOT, PESTEL, Porter’s Five Forces and Value-Chain Analyses. The report also comprises analysis of Coca Cola’s marketing strategy and company’s approach towards Corporate Social Responsibility (CSR).

[1] Clinton, B. (2009) Harvard Business Review, Available at: https://hbr.org/2009/09/creating-value-in-an-economic-crisis

[2] The Street (2015) Available at: http://www.thestreet.com/story/13043245/1/pepsico-vs-coca-cola-which-stock-is-the-better-choice-for-2015.html